All Good Markets Exist In Ethylene Glycol Market.

Analysis of domestic ethylene glycol market in June:

Source: lung Chung

Domestic glycol market continued weak shock pattern, the average price decreased by 10 yuan / ton slightly compared with last month. After the Dragon Boat Festival, the market continues to fall, the cash flow of polyester products has shrunk sharply, and the terminal enterprises are purchasing a large amount of investment because of the value of investment. After two rounds of phased procurement, the inventory of polyester enterprises was effectively released, and the overall start load was raised to 90.26%. In this month, the mainstream importers reduced the contract volume, and the domestic ethylene glycol production enterprises started to reduce the load to 64%. With the reduction of polyester enterprise contract volume, the main port delivery is in good condition, and after the middle of June, it has accumulated nearly one hundred thousand tons of storage. In addition, the easing of trade risks provides support for commodities and geopolitical instability supports the continued strengthening of crude oil. Glycol in the low price area began to strengthen slightly, but the resilience was very limited. Towards the end of the month, businesses began to worry about the restart of pre maintenance devices, and the fear of demand side began to spread. The focus of the market fell again, to close at 4375 yuan / ton.

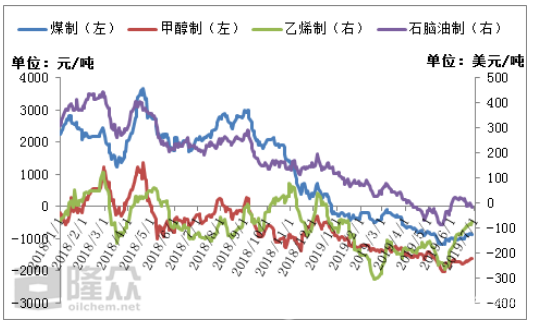

At present, the profits of domestic ethylene glycol enterprises are:

Source: lung Chung

In the last week of June, the domestic ethylene glycol market rebounded slightly, and the profitability of the various processes showed a different turn for the better. Among them, the profit from coal to ethylene glycol is -9449 yuan / ton; the profit from methanol to ethylene glycol is -1560.7 yuan / ton; ethylene glycol makes us $-88 / ton; the profit of naphtha to ethylene glycol is US $-23.7 / ton.

Maintenance situation of ethylene glycol enterprises in China:

Enterprise name | capacity | Date of maintenance |

Anhui Huaihua Group Co., Ltd. | Ten | 2018.4.28- undetermined |

Luoyang Yongjin Chemical Co., Ltd. | Twenty | 2018.12.9- undetermined |

Puyang Yongjin Chemical Co., Ltd. | Twenty | 4.2-6.20 |

Xinxiang Yongjin Chemical Co., Ltd. | Twenty | 6.1-6.8 |

Yangmei group Shenzhou Chemical Co., Ltd. | Twenty-two | 5.2-6.12 |

Xinjiang production and Construction Corps Tian Ying petrochemical Limited by Share Ltd | Fifteen | 4.26-6.20 |

China Petroleum Chemical Co Hubei Fertilizer Branch | Twenty | 5.15-6.30 |

China Salt Anhui red Quartet Limited by Share Ltd | Thirty | 5.29-6.23 |

Maoming petrochemical | Twelve | 6.17-6.30 |

Liaoyang petrochemical | Twenty | 6.17-7.17 |

Shanghai petrochemical | Twenty-three | Conversion to EO |

Total | Two hundred and twelve | |

Enterprise name | capacity | Date of maintenance |

Anhui Huaihua Group Co., Ltd. | Ten | 2018.4.25 |

Luoyang Yongjin Chemical Co., Ltd. | Twenty | 2018.12.9 |

Puyang Yongjin Chemical Co., Ltd. | Twenty | Four point two |

Anyang Yongjin Chemical Co., Ltd. | Twenty | Seven Beginning of the month |

Yongcheng Yongjin Chemical Co., Ltd. | Twenty | Six End of month |

Qianxi Qian Xi Coal Chemical Investment Co., Ltd. | Thirty | Six Month (time undetermined) |

China Petroleum Chemical Co Hubei Fertilizer Branch | Twenty | Five point one five |

Xinjiang production and Construction Corps Tian Ying petrochemical Limited by Share Ltd | Fifteen | Four point two six |

yanshan petrochemical | Eight | Six The end of July (undetermined) |

Liaoyang petrochemical | Twenty | |

Shanghai petrochemical | Twenty-three | |

Total | Two hundred and six |

In June, domestic ethylene glycol overhaul enterprises were mainly coal enterprises, involving 2 million 120 thousand tons of production capacity and 143 thousand and 200 tons of monthly loss, which did not include oil production and EO reduction and coal loss.

In July, domestic ethylene glycol overhaul enterprises were mainly coal enterprises, involving 2 million 60 thousand tons of capacity, compared with the overhaul in June, and the overall supply increased. By the end of June, the downstream polyester enterprises started to rise to 90.46%, and there is still a upward trend in the latter stage. Summing up, the total supply is negative, and it is positive from demand.

The main port inventory situation of ethylene glycol in China:

Source: lung Chung

As of June 27th, the MEG port in East China's main port area has a stock of about 1 million 139 thousand tons. Among them, 81.4 tons of Zhangjiagang, a mainstream library daily delivery of about 11519 tons; Ningbo 78 thousand tons; Shanghai and Changshu 124 thousand tons; Taicang 83 thousand tons, the mainstream reservoir area daily delivery 3314 tons; Jiangyin 40 thousand tons.

It is estimated that next week (June 27th -7 3), the port of East China is expected to arrive at 211 thousand tons, of which 125 thousand tons are planned for Zhangjiagang, 16 thousand tons for Taicang wharf, 50 thousand tons for Ningbo, 20 thousand tons for Jiangyin, and no port for Shanghai. Higher than any week in June, that is, late imports will increase.

Unit: 10000 tons

Six 13 June | Six 20 June | Six 27 June | Seven 4 E | Seven 11 E | Seven 18 E | |

Main port inventory | One hundred and twenty-three point six zero | One hundred and nineteen point eight zero | One hundred and thirteen point nine zero | One hundred and fifteen point nine zero | One hundred and fifteen | One hundred and thirteen |

Import volume | Nineteen point one zero | Sixteen point one zero | Ten point four zero | Twenty-one point one zero | Eighteen point nine zero | Eighteen point nine zero |

Ethylene glycol production | Fourteen point seven zero | Fourteen point seven four | Fourteen point nine three | Fifteen point one zero | Fifteen point two zero | Fifteen point three zero |

Total supply | Thirty-three point eight zero | Thirty point eight four | Twenty-five point three three | Thirty-six point two zero | Thirty-four point one zero | Thirty-four point two zero |

Polyester demand | Thirty-three point zero three | Thirty-three point two five | Thirty-three point four three | Thirty-four point zero two | Thirty-four point zero seven | Thirty-four point zero one |

Other requirements | Two point two four | Two point two four | Two point two four | Two point two four | Two point two four | Two point two four |

Aggregate demand | Thirty-five point two seven | Thirty-five point four nine | Thirty-five point six seven | Thirty-six point two six | Thirty-six point three one | Thirty-six point two five |

Supply and demand gap | -1.47 | -4.65 | -10.34 | -0.06 | -2.21 | -2.05 |

By the end of June 27th, the supply and demand of ethylene glycol in China was about -10.34 million tons, mainly due to increased demand for polyester, reduced imports, overhaul of enterprises, and overall supply changes were relatively small. Next week is expected to increase the volume of Hong Kong, the downstream polyester demand is less than the supply of ethylene glycol, the difference between supply and demand is estimated at -0.06 million tons.

Message side:

Xinhua news agency, Osaka, June 29, in the first meeting of the US dollar meeting held in June 29th, the heads of state of the two countries said that China and the United States resumed economic and trade consultations on the basis of equality and mutual respect. The US side said it would no longer impose new tariffs on Chinese exports. The two countries' economic and trade teams will discuss specific issues.

To sum up, the overall supply of ethylene glycol increased in July, the demand for polyester from the lower reaches increased, the air quality was offset, the import volume increased, the port inventory was expected to rise, and the profit was negative; the US and China resumed economic and trade consultations, and the terminal market was expected to turn better and better.

Ps: individuals tend to be weak and expect market prices to oscillate between 4200-4400 yuan per ton.

- Related reading

The G20 Summit Is The Focus Of The Talks. The Results Of The Talks Between China And The United States Have A Short-Term Impact On The Current Cotton Trend.

|- Instant news | 押钱试衣:不买就不退押金?

- Industry dynamics | Graduate Students Open Shop To Become "The Most Cattle Underwear King"

- News Republic | "2010 Denim Garment Industry Development Trend And Cultural Exploration Forum" Held

- Learning Area | Some Problems And Suggestions In The Implementation Of The Standard "Pajamas"

- Local projects | Wuxi Leather City: To Eliminate The False Truth

- Shoe Express | Easy Running In Hot Summer Days

- Instant news | 太康县纺织集聚区又添“新丁”

- Industry dynamics | Hunan Chamber Of Commerce In China Textile City

- Local projects | 辛集国际皮革城建设全力推进

- Industry dynamics | 石狮纺织品出口美洲市场大幅增长

- 冀鲁豫:全线止跌后 纺织市场行情依然冷清

- 鞋子与衣服之间密不可分的关系,提升气质up!up!

- Lululemon创始人认购安踏股份

- 如涵摸石过河,但网红经济的水到底有多深

- H&M 集团夏季系列开局表现良好 转型初见成效

- “鞋王”卷土重来 百丽集团控股滔搏运动赴港IPO

- 达人改造翻面式 YEEZY BOOST 350 V2

- 瑞安江南国际服装城秋冬季订货会七月八日盛大开幕!

- 新生代品牌BHAMMA发布,行业大咖齐见证

- Textile And Garment Enterprises Look At This Group Of PPT And Understand The Seriousness Of The Market.